Cookies, chaos and Chrome: The industry’s spiciest takes on Google’s reckoning

Now that the dust has settled from Google’s gut punch — being called out not just for monopolizing how people access information online but how that information is monetized — the hot takes are flying. In the absence of straight answers, the industry has done what it does best: speculate. Digiday sifted through the noise to bring you the sharpest, spiciest and most side-eye-worthy takes out there.

Google’s U-turn on third-party cookies was not part of the plan

It would be easy to chalk up Google’s every move (or lack thereof) since announcing the death of third-party cookies to a master plan. But this much is clear: The reversal wasn’t some Machiavellian scheme. It was a scramble that was drawn out over years. Extended deadlines, shifting strategies for its own third-party cookie alternatives, to even the move to offload the decision onto Chrome users — every step made the chaos impossible to hide. Along the way, the real challenge came into sharp focus. Google Chrome was trying to do two fundamentally opposing things at once: protect user privacy and preserve ad performance. It took a while, but Google finally realized it and called time on its five-year crusade.

“Google’s decision to stall cookie deprecation doesn’t feel like a product timeline delay — it feels like a strategic calculation,” said Ravi Patel, CEO and co-founder of media platform SWYM.ai. “With the antitrust case looming and the real possibility they’ll have to dismantle parts of their ad business, this move preserves what they can while they still can. If GAM or other core parts of the stack come under fire, holding onto the signal advantage in Chrome becomes a lifeline.”

Google’s cookie alternatives are on life support

The so-called Privacy Sandbox has been struggling since day one — tangled in technical headaches, industry skepticism and regulatory red tape. Once positioned as the future after third-party cookies, it’s now a symbol of just how far that future slipped out of Google’s grasp. As the dust settles, many in the industry are quietly asking whether the sandbox even has a future despite Google’s insistence that it does. After all, if these tools couldn’t win traction when cookies were on death row, what hope do they have now when the execution’s been called off? Ad executives are wary of sinking more time, money and engineering talent into a platform that feels one broken promise away from being mothballed. Given Google’s recent track record, who could blame them?

“The Privacy Sandbox has clearly entered a precarious phase in its mission to strengthen privacy while ensuring a sustainable, ad-supported internet,” said Gartner analyst Andrew Frank. “I believe the mission must continue but its governance will likely need to evolve.”

The cookie survived but it’s looking pretty picked over

Third-party cookies may have survived but they’re not exactly thriving. Sure, advertisers will still lean on them for reach and frequency management in Chrome, but the bigger picture is clear: Cookies have already been neutered on all browsers (including Chrome on Apple devices for years thanks to Apple’s Intelligent Tracking Prevention tech). Meanwhile, first-party cookies (like those from Meta, TikTok, Snap, et al) are alive and well. Survival, as it turns out, isn’t the same as strength. And even that survival is shaky. If Google is forced to spin off Chrome, a new owner without a legacy ad tech business would have little incentive to keep third-party cookies alive at all.

Nothing has actually changed — and won’t for some time

After years of warning about Google’s monopoly and bracing for a future without third-party cookies, ad execs finally have a reason to feel a little smug — and a little relieved. But they shouldn’t get too comfortable. Nothing here is final. Not yet, anyway. Google is gearing up to fight the monopoly ruling tooth and nail, and when it comes to third-party cookies, few in the industry believe this latest U-turn is the final plot twist. If history is any guide, the next one is already in the works.

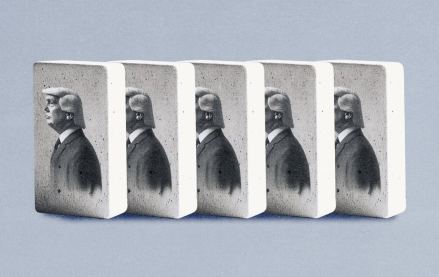

Google is on the brink of a break-up

It took two decades, but antitrust law finally caught up with Google. Over the past year, U.S. government lawyers have successfully argued that the tech giant built illegal monopolies. Now the proposed remedies could start to reshape the web itself. First, there’s the antitrust trial targeting Google’s search dominance, where the government is pushing for a spinout of the Chrome browser. Second, a U.S. district judge has ruled that Google holds an illegal monopoly over key parts of the ad tech market, with remedies set to be debated next month. Taken together, these cases represent the biggest threat to Google’s empire — and the most significant shake-up to online advertising — in years. The government may not get everything it wants, but at this point, it’s a safe bet they’ll get something.

Marketers and publishers are conflicted over the Google monopoly schadenfreude

On the surface, the idea of breaking up Google sounds like a win for advertisers and publishers. They’ve spent years — publicly and privately — grumbling about the tech giant’s stranglehold on ad dollars. But for all the frustration, there was little choice but to play along. Google’s scale, reach and effectiveness made it too valuable to walk away from, no matter how bitter the taste. And that’s exactly why the prospect of dismantling it now makes marketers and publishers so uneasy. Breaking up Google could end up doing more harm than good — rattling the market, inflating costs and leaving few real alternatives. For now, all eyes are on Chrome and whatever remedies the courts decide to impose on Google’s ad tech empire.

Google doesn’t even want its ad tech — well, the side of it at least

It’s no secret that the slice of Google’s ad tech empire tied to selling ads on the open web isn’t exactly its crown jewel. If anything, Google has been quietly managing its decline for years. Last year it raked in $31.2 billion, down from $32.8 billion in 2022. At this point, it’s fair to wonder if Google even wants it anymore, especially considering the headaches it’s caused. That theory only gains steam when you remember Google already offered to sell off its ad exchange to appease European Union regulators. And if upcoming remedies slash margins even further — and heap on more scrutiny — it’s hard to see Google fighting to hang onto it.

More in Marketing

Q1 was a win for The Trade Desk, but bigger tests lie ahead

The Trade Desk rebounds but agency tensions and strategic doubts linger.

Quotes from the quarter: What CEOs and CFOs are saying about the state of ad spend

At this stage even a rollback of tariffs might do more harm than good because what goes down could just as easily snap back up. The volatility itself has become the risk.

‘Made in USA’ is trending on Amazon, and sellers are leaning in

According to new data from e-commerce analytics firm SmartScout, discovery-oriented searches like “made in USA products only” have surged.