Privacy fatigue is setting in after Google’s cookie U-turn. But the search for alternatives hasn’t stopped

For years, privacy was treated as advertising’s great reckoning. The introduction of the General Data Protection Regulation in 2018, Apple’s crackdown on mobile identifiers and the slow death march of third-party cookies in the largest browser — it all painted a picture of a future where platforms would be reined in, marketers would be forced to adapt and users would finally gain some measure of control over their data.

That future never quite arrived.

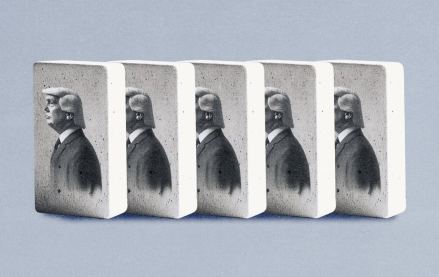

What followed instead was a slower, stranger drift: enforcement grew spotty. Regulatory efforts stalled and the largest platforms — Google, Meta, Amazon — emerged with even more concentrated power than before. Fines dried up. Reforms got diluted or delayed. And cookie deprecation, once symbolic of the new era, came full circle when Google confirmed it wouldn’t eliminate third-party cookies from Chrome after all.

Rather than leveling the playing field, the privacy era has mostly reconfigured it — redrawing the boundaries in ways that preserve, and in some cases expand, the dominance of those who were supposed to be disrupted.

To some, that wasn’t a twist. It was the natural outcome of a system where platforms, not regulators, have long dictated the terms of engagement around privacy. The past month only confirmed this dynamic: Apple’s privacy rules were fined by French regulators, Google stepped back from deprecating third-party cookies. It seems as if advertising’s much-vaunted pivot to privacy slammed into a wall — and bounced off.

“Ever since Cambridge Analytica, the privacy movement has been moving forward full steam ahead with the ad industry developing different types of PETs, clean rooms and ID solutions,” Shiv Gupta, U of Digital’s founder, said on the ad tech education firm’s podcast earlier this week. “But for the first time it seems as if the industry’s privacy crusade is starting to lose some of that momentum.”

Well to a point, at least.

Europe’s regulatory momentum may be flagging — thanks to stalled efforts to push through reforms to the ePrivacy directive and a quiet softening of the GDPR’s more complex provisions — but it hasn’t vanished. And in the U.S., enforcement remains inconsistent but it still packs a punch — just ask American Honda Motor Co.

Meanwhile, the industry itself hasn’t hit pause. Chrome’s decision to stick with third-party cookies might have taken the urgency down a notch, but the broader shift away from those cookies hasn’t stopped. In fact, much of the ecosystem has already moved on. Safari and Firefox made cookies obsolete years ago, and mobile, the heart of modern media consumption, was never built around them to begin with. Put another way: Third-party cookies are still widespread but they’re no longer foundational. The shift is already underway, it’s just no longer waiting on Chrome.

“A major advertiser reached out to us today [April 23] to tell us that they still want to be testing cookie-less solutions,” said Matt Sattel, chief revenue officer at OpenX.

Why? Because they want to measure the performance gap between impressions bought with third-party cookies and those bought without. Whatever Chrome’s stance, this marketer wants alternatives that scale. Third-party cookies may still be available, but they remain a liability — technically, legally and reputationally. That’s why the search for alternatives never really stopped.

As Sattel explained: “The fact that this came from a senior marketer when it did shows that privacy is still top of mind for a lot of buyers in spite of what is or isn’t happening to third-party cookies.”

For marketers like this, the lesson’s clear: Whatever they’re building to target or measure ads needs to be built to last. It has to withstand platform shakeups, legal curveballs and everything in between. That means treating identity not as a single bullet but as a portfolio — one that blends authenticated IDs, probabilistic tools, contextual signals, cohort-based strategies and tight data partnerships with publishers. Because when one piece falters, the rest need to hold.

“We now had a major auto client in the U.S. replace deterministic [data] sets with fully contextually indexed sets for the rest of this year, and they put meaningful spend through the product,” Audigent CEO Drew Stein said on a panel at Ad Week Europe earlier this month. “It’s not just good from an ecosystem perspective. It’s great from a performance perspective.”

Performance, after all, is where much of this experimentation pays off. According to OpenX, Safari display inventory is on average 70% more economical than traditional addressable channels, and video is 45% more so. Moreover, solutions that unlock previously unaddressable environments aren’t just privacy-compliant; they can offer cost savings for marketers and fresh monetization for publishers. Case in point: OpenX and ID5’s partnership has helped increase Safari desktop reach by 58% and mobile traffic by 37% compared to cookie-only strategies.

“The promise of this privacy shift was supposed to be user empowerment and platform accountability,” said Ravi Patel, CEO and co-founder of media platform SWYM.ai “Instead, we’ve ended up with an ecosystem where the largest players can rewrite the rules whenever it suits them — and everyone else is left scrambling to adjust. It’s a reminder that real change won’t come from platforms self-regulating. It’ll have to come from the buy side demanding better.”

That moment may still feel distant, but it’s no longer out of sight. Small shifts are happening. Marketers are asking harder questions. Scrutiny is building. And the sense that privacy must be owned, not outsourced, is finally starting to take hold.

More in Marketing

Quotes from the quarter: What CEOs and CFOs are saying about the state of ad spend

At this stage even a rollback of tariffs might do more harm than good because what goes down could just as easily snap back up. The volatility itself has become the risk.

‘Made in USA’ is trending on Amazon, and sellers are leaning in

According to new data from e-commerce analytics firm SmartScout, discovery-oriented searches like “made in USA products only” have surged.

Q&A: Uber Ads hits $1.5 billion run rate as it hires first head of measurement

As Uber’s ad business scales past $1.5 billion, it hires first head of measurement.